New Illinois Birthday Rule For Medigap Plans

Each year, Illinois Medigap recipients between the ages of 65 and 75 will have a chance to change their current Medigap plan. The new policy must be of equal or lesser benefit. Additionally, the new policy must be from the same carrier.

The time during which this change is possible is a 45-day window that the Illinois birthday rule provides. Starting on their date of birth, people with existing Medigap plans may make such changes without the need for medical underwriting. This rule allows policyholders to review their coverage when they may not otherwise face denial from a plan due to pre-existing health conditions.

Why Can We Do It Better

We are a customer-focused independent insurance agency that specializes in Medicare and the options to supplement it. We have relationships with dozens of insurance companies, allowing us to meet your specific needs at the best price possible. Our company has been serving clients across the country for almost 70 years and would like to earn your trust and business. Call us or fill the form out below today!

We will take all the time needed to review your current coverage with you and make suggestions on better priced options. The same coverage in most cases, but possibly priced better. If you have been on the same plan for 2 or more years, its time to look around.

With almost 70 years of experience and having worked with people on Medicare since it started in 1966, we consider ourselves experts in this area. We have helped thousands of seniors over the years make the best decisions for their Medicare Coverage. We have fully licensed, educated and caring agents to help discuss options with you.

We believe in educating the client about the products and options available. We have full time customer service on staff who are ready and able to handle any questions or concerns that may arise – anytime. Can your current agent say that? Have they even called to discuss the Birthday Rule with you?

Medicare Advantage In California

Although Medicare is funded and run by the federal government, enrollees can choose whether they want to receive their benefits directly from the federal government via Original Medicare or enroll in a Medicare Advantage plan offered by a private insurer, if such plans are available in their area. There are pros and cons to Medicare Advantage and Original Medicare, and no single solution that works for everyone.

Although most counties in the United States do have Medicare Advantage plans available for purchase, there are several counties in northern and central California where Original Medicare is the only option. Of the 58 counties in California, Medicare Advantage plans are available in 43 of them as of 2021. Across those 43 counties, plan availability varies from just two plans in Nevada and Butte counties, to 102 plans in some parts of Los Angeles County.

But 40 percent of Medicare beneficiaries in California were enrolled in Medicare Advantage plans as of 2018, compared with an average of 34 percent nationwide. More than 2.9 million people with Medicare in California, nearly 46 percent of Californias Medicare beneficiaries, had private Medicare Advantage plans as of October 2020 . So Medicare Advantage enrollment is growing in California, just as it is nationwide.

Learn about how California Medicaid can provide assistance to Medicare beneficiaries with limited financial means.

Also Check: Men’s Delivery Birthday Gifts

A Birthday Rule In Five States Allows Users To Switch Medigap Plans

Of those eleven states, five have implemented a birthday rule that allows Medigap enrollees to switch Medigap plans without medical underwriting around the time of their birthday . To qualify, you need to already be on a Medigap plan.

If you live in one of these states, you may want to take advantage of these birthday rules as long as you understand how they work.

How Medicare Part D Prescription Drug Plans Differ Between States

Medicare Part D prescription drug plans are private insurance plans that work with Original Medicare to help cover the costs of your prescription medicine. Many Medicare Advantage plans also provide prescription drug coverage.

Plan prices and plan availability varies from state to state, but all states are required to have open enrollment in Medicare Part D plans at the same time as open enrollment for Original Medicare October 15 to December 7 every year.

The availability of Medicare Part D plans vary from state to state. The number of plans available in any state in 2019 ranged from 22 choices in Alaska to 30 choices in California, Pennsylvania and West Virginia, according to the Kaiser Family Foundation.

Recommended Reading: Does Chili’s Give Free Dessert On Birthday

Is Medicare A State Or Federal Program

Medicare is a federal program, meaning that its eligibility and coverage are mostly the same across the U.S. Its important to remember that this distinction is only the case for Original Medicare, which includes Parts A and B. If you have Original Medicare, there is essentially no difference in coverage depending on where you live.

This is not true of Medicare Advantage plans, which vary significantly by the state in cost and coverage. Medicare Advantage plans, or Medicare Part C, are provided by private insurers and include additional benefits and coverage beyond the scope of Original Medicare.

Medicare Part D, an optional benefit to cover prescription drugs, also varies by state and region.

Who Should Consider Switching Medicare Supplement Plans

Typically, Medicare insurance experts suggest that cost, or saving money, is the primary reason to consider switching. The 2022 Medicare Supplement Insurance Price Index found a wide spread in rates available in every of the top-10 U.S. markets.

For example, in Chicago a 65-year-old man could purchase Plan G coverage for as little as $130-per-month. The highest rate for Plan G coverage for a 65-year-old male is $270.35. In Phoenix identical Plan G coverage for a 65-year-old woman ranged from a monthly low of $115.52 to $345.56.

Insurance companies have the right to review plan premium amounts annually for both new and existing policyholders. The Birthday Rule can be extremely beneficial for those who face a rate increase in their yearly premium.

You May Like: Best Birthday Card For Husband

Guaranteed Issue Rights And Open Enrollment Periods

Guaranteed issue rights are protections for Medicare enrollees in certain situations. These rights prevent insurance companies from denying enrollment in certain Medigap policies when beneficiaries meet specific criteria.

To utilize guaranteed issue rights, beneficiaries must abide by MACRA when selecting their plan. At this time, only those who enrolled in Part A before January 1, 2020, can be guaranteed issue to Plan F or Plan C.

Like guaranteed issue rights, Open Enrollment Periods allow beneficiaries to enroll in a Medigap plan with no underwriting health questions. Those who receive Medicare after January 1, 2020, must abide by MACRA when in an open enrollment period. Thus, individuals who enrolled in Medicare prior to January 1, 2020, may enroll in any Medigap plan they wish.

Medicare Spending In California

In 2018, Original Medicares average per-beneficiary spending in California was $9,868, based on data standardized to eliminate regional differences in payment rates .

Nationwide, average per beneficiary Original Medicare spending was $10,096 per enrollee, so Medicare spending in California was about 2 percent below the national average. Per-beneficiary Original Medicare spending was highest in Louisiana, at $11,932, and lowest in Hawaii, at just $6,971.

You May Like: Ice Skating Birthday Party Invitations

California And Oregon The Original Medigap Birthday Rule States

Prior to this year, only two states provided Medigap plan participants with a special opportunity, commonly called the Birthday Rule. The rule allows policyholders an open enrollment period each year surrounding their date of birth.

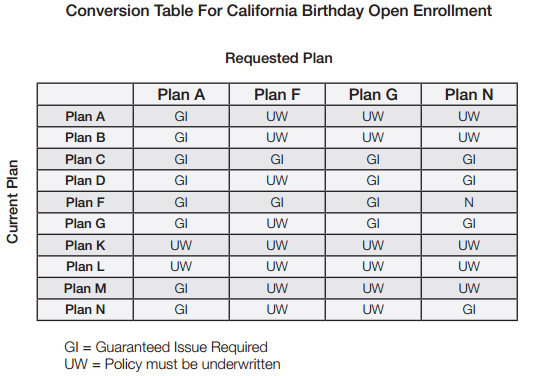

In California, the rule applies to all residents with a Medigap policy. Starting 30 days before your birthday you can change to any other Medigap plan of equal or lesser benefits with the insurance company of your choice. No health underwriting questions need be answered during this special open enrollment. As of January 1, 2020 the opportunity has been extended to 60 days.

Oregon has similar rules allowing policy owners to switch to any carrier or plan of equal or lesser benefits. The opportunity starts on your date of birth and ends after 30 days.

Can I Switch Policies

In most cases, you won’t have a right under federal law to switch Medigap policies, unless one of these applies:

- You’re eligible under a specific circumstance or guaranteed issue rights

- You’re within your 6-month Medigap open enrollment period

You don’t have to wait a certain length of time after buying your first Medigap policy before you can switch to a different Medigap policy.

Also Check: Birthday Dinner Menu Ideas For Adults

Is Medicare Different In Each State

Home / FAQs / General Medicare / Is Medicare Different in Each State

Even though Medicare is a federal program, states can implement various rules if they meet the basic Medicare regulations. Most states across the country have implemented rules to ease the requirements for seniors to make changes to their Medigap plans. Below, we will highlight unique Medicare rules and their applicable states.

Next Steps For The Ca Birthday Rule

1) Check your bill to confirm the price of your current Medigap plan2) Check our instant online Medigap quotes to see competitive prices.3) Call Senior65 at 800-930-7956 before it has been 60 days from your birthday.

Senior65 will help you switch plans right over the phone. There is never a fee or hidden charge to work with Senior65.com. Since Medicare insurance pricing is regulated, no one can sell you the same plan for less than we can.

Recommended Reading: Fun Things To Do For A Halloween Birthday Party

Ca Medigap Birthday Rule

California Extends Switching Deadline for Medicare Supplement plans

Covid 19 has ruined many birthdays in 2020 and 2021. The CA Birthday Rule 2020 is one positive change that has come in this year of challenge. CA Senate Bill 407 has made it so residents of the Golden State now have 60 days after their birthday to switch Medicare Supplement plans.

Even if you have a pre-existing condition, you can switch to an equal or lessor benefit plan during this time. This article is only about sunny California. If you live in a different state and want to switch Medicare Plans, please visit our Medicare Switching Guide.

What Help Is Available

One of the biggest benefits of working with a licensed insurance agent is that your agent will continue to advocate for you and provide you with service even after you initially sign up for a Medicare policy and any Medigap policies.

This becomes especially important when your birthday comes each year and you have the opportunity to re-evaluate how much you pay for your supplemental insurance policies and the coverage they provide.

Because agents work with several different insurance carriers, they can provide you with options and several price points to consider. In doing this, their advice and services are free to you because they receive a commission paid by the insurance company.

A licensed insurance agent who is an expert in Medicare coverage can help you navigate the confusing nature of Medicare, make sure you dont miss important deadlines, and ensure that if you do decide to change supplemental policies, that you still get the coverage you need to meet your specific needs.

You May Like: Birthday Party Ideas For A 14 Year Old Teenage Girl

What Is Involved In The Application

With most insurance companies in California, they will ask for a picture of your current Medicare Supplement ID card and proof that your policy is currently paid. This is usually a snapshot from a bank statement or some other proof that the policy is active and paid up.

There are a few CA carriers that dont require any proof at all.

Contact us at to find out more about the birthday rule and we can tell you how much you can potentially save!

Aamsi Reports That The Medigap Birthday Rule Provisions Vary By State

If you are an agent in one of the five states and have a website, create a page specifically explaining the rules, Slome suggests. If you use social media like Facebook or Instagram, add posts that will catch seniors eyes. Email people a month before their birthday suggesting they contact you for Birthday Rule information. These are all ways to generate awareness and potential leads without having to spend money.

For consumers, Slome acknowledged that finding the best Medicare Supplement insurance plan and pricing can be a formidable task. In some areas there are as few as five different Medigap plans to choose from, the expert says. While in others, there can be 20 or more different plans available from insurers.

The American Association for Medicare Supplement Insurance makes available a free online directory listing local Medicare insurance agents. Agents listed also have access to free marketing tools designed to generate prospects. For consumers seeking information and cost comparisons, those agents who are listed will offer no-cost information and often are able to compare both Medicare Advantage as well as Medicare Supplement coverage.

Recommended Reading: How To Add A Birthday Hat To A Photo

What The New Birthday Rules Mean

The start of the states new Medigap policy birthday rules could give insurance agents and brokers a new chance to reach out to Medigap users.

The new rules could also help insurance producers in the affected states present Medigap policies as attractive alternatives to Medicare Advantage plans.

For the affected health insurers that issue Medigap policies, the new rules will create a framework for offering plan switches on a guaranteed-issue basis, which may reduce the odds that sudden gushers of claim risk will cause some issuers to capsize.

But, because many of the plan switchers will be people with serious illnesses, hoping to get access to the best care providers for their conditions, the new rules could also add claim cost management headaches, at a time when the COVID-19 pandemic is already complicating efforts to predict and manage health care costs.

Differences In Medigap Plans Between States

Medicare Supplement insurance also known as Medigap policies help you cover your out-of-pocket expenses if you have Original Medicare. Its the only private Medicare-related insurance for which the federal government does not set a mandatory open enrollment period.

You have six months starting with your 65th birthday and once youre enrolled in Medicare Part B to buy a Medigap policy available in your area.

After that, youre often locked into the Medigap plan you choose. It is difficult or extremely expensive to switch to another Medigap plan in most states.

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts. Plans in those states may have options that differ from Medigap plans in other states.

Examples of Rare State Rules for Medigap

Medicare does not require states to guarantee access to Medigap plans for people under 65 who qualify for Medicare due to a disability such as End-Stage Renal Disease or ALS . But most states have some type of rule in place giving people with these conditions access.

You May Like: Places To Have A Small Birthday Party

Are Birthday Rules Likely In More States

Life is not predictable and your medical needs may change over time. What you can afford may change too. You deserve the opportunity to find an affordable plan that works for you.

While Medigap is an excellent option for people on Original Medicare, some policyholders may feel that they are locked into Medigap plans with high rates. Guaranteed issue rights can help, but the situations outlined by CMS are limited to very specific situations that apply to relatively few policyholders.

These states are being proactive for your health. As more of them enact these birthday rules, more Medicare beneficiaries will have the opportunity to shop around for plans. This will increase the market competition for Medigap plans in those states and could hopefully drive down rates.

Keep an eye out for more birthday rules in the future.

Tanya Feke M.D. is a licensed, board-certified family physician. As a practicing primary care physician and an urgent care physician for nearly ten years, she saw first-hand how Medicare impacted her patients. In recent years, her career path has shifted to consultant work with a focus on utilization review and medical necessity compliance. She currently works as a physician advisor at R1 RCM, Inc., where she performs case reviews for hospitals nationwide.

How To Enroll In Medicare Supplement Plans In California

If you enroll in Medicare during your at age 65, the first time you can enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment Period. For many beneficiaries in California, this is the only opportunity you receive to initially enroll in a Medicare Supplement plan without underwriting health questions.

If you received Medicare due to a disability before age 65, you get two . The first comes when you initially enroll in Medicare, and the second happens when you turn 65. This ensures you get the opportunity to enroll in any Medicare Supplement plan available, as many plans are not available to those under age 65.

Suppose you delay enrolling in a Medicare Supplement plan due to . In this case, youll get a that will allow you to enroll in a Medicare Supplement plan without underwriting health questions.

Compare Medicare Plans

Find the most affordable Medicare Plan in California!

Also Check: Kendra Scott Birthday Discount Code

What Is The Birthday Rule For Medicare

The Birthday Rule is a very important requirement to know if you have a Medigap policy or are approaching the age when you are eligible for Medicare.

Although Medicare is a federal program, in the state of California , Medigap enrollees have the benefit of a state law that allows you to change your Medicare supplement insurance with no medical underwriting, as long as this is done within 30 days before or after your birthday.

Known as the Birthday Rule, this law carries many benefits for Medicare policy holders, and is especially important to understand for those who have signed up for Medigap policies.

Below, well outline:

- What Medicare supplemental insurance is

- How the Birthday Rule impacts Medigap

- Why its important for those who have Medigap policies

- What help is available to assist you with any questions about Medigap and the Birthday Rule