Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

Common Errors For The Earned Income Tax Credit

Understand the common errors you can make when you claim the Earned Income Tax Credit on your tax return and what you need to do to avoid them.

Youre responsible for whats on your tax return even when someone else prepares it for you. If the EITC claim on your tax return has errors, one of the following may happen:

- It may take longer for you to get your refund

For help, use our Qualification Assistant.

Can Companies That Promise To Clean Up My Credit Report Really Do That

The Federal Trade Commission and the Consumer Financial Protection Bureau say that you should be wary of companies that claim they can repair your credit. These companies are commonly called credit clinics. They don’t do anything for you that you can’t do on your own for free.

Beware of organizations that offer to create a new identity and credit report for you. The FTC, CFPB, and state attorneys general have filed legal actions against some of these organizations. The FTC, CFPB, and others warn that the following claims or actions signal that you may be dealing with a credit clinic:

- The company asks for money up front and charges you before they’ve performed their services.

- The company guarantees to remove late payments, bankruptcies, or similar information from a credit report.

- The company charges a lot of money to repair credit.

- The company asks you to write to the credit reporting company to verify the same credit account information in the file, over and over, even after the information has been determined to be correct.

- The company doesn’t want to or can’t provide a business address.

- The company pushes you to decide to engage them right away.

For additional helpful information about credit clinics, please visit the CFPB’s website or the FTC’s website.

Also Check: Best Birthday Dinner Restaurants Nyc

Review Your Reports For Mistakes Inaccuracies Items That Shouldn’t Appear

After you get your credit reports, be sure to review them and dispute any inaccurate information you find. If you’re planning to make a big purchase, like a house or a car, or a significant financial commitment, such as refinancing your mortgage, you might want to review information from all three agencies well in advance.

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

Don’t Miss: Where To Order Birthday Balloons

Re: Wrong Date Of Birth

Personal Aphorism:“Forget What You Feel, Remember What You Deserve”09/2017: EX 641 EQ 634 TU 64704/2022: EX 796 EQ 793 TU 79004/2022: EX 790 EQ 788 TU 782800sMy AAoA:My AoOA:Inquiries:Report Status:Garden Status:Without patience, we will learn less in life. We will see less. We will feel less. We will hear less. Ironically, rush and more usually mean less.2

I Noticed That My Date Of Birth In Social Securitys Records Is Wrong How Do I Get That Corrected

Answer: To change the date of birth shown on our records, take the following steps:

Complete an application for a Social Security card

Show us documents proving: U.S. citizenship age identity and take your completed application and documents to your local Social Security office.

Note that all documents must be either originals or copies certified by the issuing agency. We cannot accept photocopies or notarized copies of documents. For details on the documents youll need, visit www.socialsecurity.gov/ss5doc.

: Brainerd Dispatch May 12, 2014

Notice: The Read more link provided above connects readers to the full content of the posted article and/or external information sources. The URL for any links are valid on the posted date socialsecurityreport.org cannot guarantee the duration of the links validity. Also, the opinions expressed in these postings are the viewpoints of the original source and are not explicitly endorsed by AMAC, Inc. or socialsecurityreport.org.

Also Check: Birthday Ideas In Omaha For Adults

How Is A Credit Report Made

The national credit bureaus maintain millions of consumers’ credit histories, based on information supplied by lenders and other entities. Each file includes records relevant to a person’s history borrowing and making monthly payments. For identity verification purposes, your credit file also contains information such as your current name and any other names you may have used in the past, current and past addresses and your date of birth.

A credit file is not set in stoneit’s a living and breathing record that’s constantly being updated with the latest information being provided to the bureaus by your lenders and other institutions. When a company such as a lender, insurance provider or potential employer requests to check your credit, the bureau pulls the contents of your credit file that are relevant and disclosable by law to the company, and packages it in an organized document known as a credit report.

Your credit report does not contain all the data in your credit filethe credit bureaus have your full payment history on record, for instance, but are typically authorized to release only records for the last seven years. Your credit report also cannot be provided to just anyone there are strict limits on the types of companies that can check your credit and when they are allowed to do so.

What If Social Security Has Your Birthday Wrong

I noticed that my date of birth in Social Securitys records is wrong. How do I get that corrected?

You must complete an application for a Social Security Card and then show us documents proving U.S. citizenship , age and your identity. Take or mail your completed application and documents to your local Social Security office. Note that all documents must be either originals or copies certified by the issuing agency. We cannot accept photocopies or notarized copies of documents. For details on the documents youll need, visit www.socialsecurity.gov/ss5doc.

Joanne Crane is district manager of the Social Security office at 3310 Route 66, Neptune, NJ 07753. Call 800-772-1213 for information.

Recommended Reading: Birthday Dinner Menu Ideas For Adults

Q What Is The Procedure For Releasing A Copy Of A Consumer Disclosure To Me If I Have Power Of Attorney Rights

If the appropriate information has been supplied, TransUnion will send the Consumer Disclosure to the Power of Attorneys address via standard mail.

Is It Important To Dispute An Old Address On Your Credit Report

It isn’t important to dispute the address with the credit bureaus, but you should follow up and learn why that old address was listed. For example, if you forgot to update your address with your credit card company, then it is important to update that information. Doing so will update your information with the credit bureaus, so it isn’t important to dispute it directly with them.

You May Like: Where To Go For Your 14th Birthday

Impact Of Identity Theft On Your Credit Report

Identity theft when someone steals your personal information and uses it to open new financial accounts can wreak havoc on your credit. These new accounts show up on your credit record and hurt your score, especially if theyre delinquent or if the identity thief applied for several in a short amount of time.

Cleaning up your credit after identity theft can take anywhere from several months to years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. This is why keeping a close eye on your report and learning how to protect yourself from identity theft will help you to keep your information safe.

How to remove negative items related to identity theft

If you believe youve been a victim of identity fraud, file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

To prevent further damage to your credit history, these are the steps you should take:

- Notify the incident to Transunion, Experian and Equifax through phone or mail

- Place a security freeze and fraud alert on your credit report

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service

What Is A Credit Score

A credit score is a number. It is based on your credit history. But it does not come with your free credit report unless you pay for it.

A high credit score means you have good credit. A low credit score means you have bad credit. Different companies have different scores. Low scores are around 300. High scores are around 700-850.

Also Check: Happy Birthday Yard Signs Houston Tx

What Is In A Credit Report And How Do You Read It

A credit report is a readable presentation of the data stored in your electronic credit file at one of the three national credit bureaus . The information stored in your credit file at each bureau is essentially the same, but each bureau organizes the data differently, and each formats its credit report in its own way.

Your Experian credit report is divided into four sections:

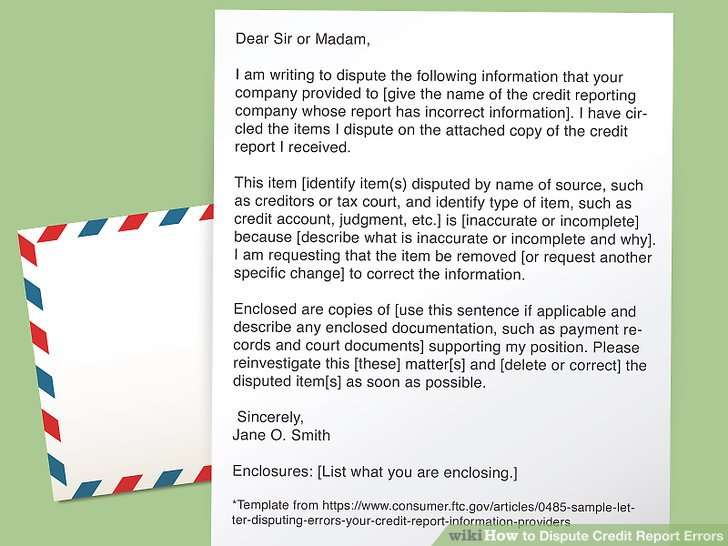

Consider Contacting A Data Furnisher

When disputing credit report errors, the FTC recommends sending a dispute letter to the data furnisher as well. A data furnisher is a financial institution, such as a lender or credit card issuer, that provides data to the credit bureaus. Each credit report that includes the error should list the furnishers name and address. If you dont see an address listed, contact the company.

Once you submit your dispute to the furnisher, it has 30 days to conduct an investigation. If it finds that the information youre disputing is inaccurate, it is required to notify each credit bureau it has reported the information. However, if the information is found to be accurate, it will remain on your credit report.

Also Check: Birthday Gifts For Long Distance Friends

It Is Telling Me My Birthday Is Wrong And So The Irs Rejected My Tax Return But That Is My Correct Birthday On The Form I Filled Out

Please take a look at our FAQ on fixing a rejected return below:

If you verified that the information you entered into TurboTax exactly matches the Social Security card, and that the birth date is correct and has been entered in MM/DD/YYYY format, your next step is to call the Social Security Administration at 1-800-772-1213 to verify that the SSA’s records are correct. Correct SSA records will prevent the same rejection next year.

In the meantime, your best option is to file a paper return, as your return will continue to get rejected until the mismatch is fixed at the SSA, which can take at 46 weeks or even longer.

What Is A Credit History

Sometimes, people talk about your credit. What they mean is your credit history. Your credit history describes how you use money:

- How many credit cards do you have?

- How many loans do you have?

- Do you pay your bills on time?

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards.

Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

You May Like: Free Coffee On Your Birthday

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- SSN

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

- Canceled check or money order stub showing a bill has been paid

If Your Credit Reports Contain Errors Or Outdated Information Heres How To Dispute Those Items With The Credit Reporting Bureaus

By Amy Loftsgordon, Attorney

A “credit report” is a detailed record of how you’ve managed your credit over time. Credit reporting agencies, like Equifax, Experian, and TransUnion, collect data from creditors, lenders, and public records to produce the reports. The agencies then sell the reports to current and prospective creditors, and anyone else with a legitimate business need for the information. For example, lenders use credit reportsor the that results from the data in itto help them decide whether to grant you credit and, if so, under what terms. The better your credit report, the more likely your credit request will be granted, and the lower your interest rate will be. Many landlords, employers, and insurance companies will also consider your credit history when making a decision.

So, your credit report is either a valuable asset or a liability, depending on its contents. The Fair Credit Reporting Act requires credit reporting agencies to adopt reasonable procedures for gathering, maintaining, and distributing information. It also sets accuracy standards for creditors that provide data to agencies. Even with these safeguards, credit reports often have errors and inaccuracies.

In this article, you’ll learn:

Read Also: What Is Bernie Sanders Birthday

What To Do If Youre A Victim Of Credit Card Fraud

Contact your financial institution immediately if your credit card is lost or stolen. Contact it if you find payments on your credit card statement that you didnt make or approve.

If you think youre a victim of credit card fraud:

- write down what happened and how you first noticed the fraud

- contact your credit card issuer to tell them about the fraud

- take notes of who you talked to and when you spoke to them

- keep all documents that you think might be helpful when the police investigate the fraud

- contact your local police service to file a complaint

- contact other accounts that could be tampered with by the person

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

Recommended Reading: Birthday Party Ideas For Middle Schoolers

Equifax Must Provide Free Copies Of Your Credit Report

A data breach at Equifax in 2017 compromised the personal information of at least 147 million consumers. As part of a court settlement related to the hack, everyonewhether they were affected by the breach or notcan get six more free credit reports from Equifax each year, beginning in January 2020, for the next seven years.

How Can I Prevent Errors On My Credit Report

Monitoring your credit report regularly is the single best way to spot errors. You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies for free.

When applying for credit, always provide as much personal identification information as possible on the credit application. If you prefer to go by a nickname, be sure to stay consistent, but be aware that the more name variations in your credit report, the more likely errors can happen.

Make sure your creditors have current and complete address information for you.

Examine your bills carefully to make sure that the charges are yours and that balances are correctly shown.

Recommended Reading: Birthday Cake Delivery San Francisco

When Is Inaccurate Information An Indicator Of Fraud

One reason you want to regularly review your credit reports for inaccurate information is to detect when someone uses your personal information to fraudulently open an account in your name.

For instance, if you see an open credit account or loan on your credit report that you never applied for, that could be a good indication that you’re a victim of identity theft. If this happens, you should contact the creditor to report the account as fraudulent and have it closed.

You can also dispute the fraudulent account with the credit bureaus to have it removed from your credit reports, and add a fraud alert or freeze your reports to make it more difficult for someone to use your credit to open an account in the future.

However, inaccurate personal information isn’t always an indication of fraud. Someone may apply for a credit card as Robert Smith and a loan as Rob Smith, and both variations of their name could appear on their credit report. Similarly, old personal information may remain on your credit report even if you change your name, address or phone number.

If asking a creditor to update inaccurate personal information doesn’t work, you can also file a dispute with the credit bureau to correct inaccurate personal information.